2019 Charitable Donations – What You Need to Know

It’s that time of year where charitable donations kick into high gear.

And while you may know everything about the organizations you support. Do you know how your charitable giving affects your tax strategy?

While organizations are going to be fighting to get in front of you to further their mission. Changes in the tax code can affect how much you want to donate this year before the end of year deadline. Therefore it is essential to understand the giving strategies that could benefit the causes you support while ensuring you get the most out of your hard-earned money.

The following are answers to the top questions you may ask want to ask your wealth advisor. If you don’t have a wealth advisor, contact Premier Wealth Management for a consultation.

Let’s TalkCan I still take a charitable deduction?

Yes. Congress continues to value the charitable deduction and supports the tax incentives associated with giving. If you itemize your tax deductions, you can still take a deduction for a charitable contribution; in fact, it was expanded in some cases.

Does the increased standard deduction affect the tax benefit I receive for charitable giving?

It could, but it depends on your specific situation.

In 2019, the standard deduction rose to $12,200 for individuals and $24,400 for married couples filing jointly, nearly double the pre-tax reform standard deduction in 2017. Tax reform made the number of households itemizing their deductions drop significantly—from about 37 million to an expected 16 million in 2018. Although more middle-class families now opt for the standard deduction, wealthier taxpayers continue to itemize their deductions.

If you’re in the latter group, with deductions totaling well over $12,200 (or $24,400 if you file jointly), your charitable deduction likely remained the same. But if you itemized your deductions in the past, and now instead take the standard deduction, you no longer receive a specific tax benefit for charitable giving.

How could the change in state and local tax deductions impact my giving?

The tax reform law capped federal deductions of state, local and property taxes at $10,000, which could disproportionately affect residents of high-tax states such as New York, New Jersey, and California.

New Yorkers, for example, deducted an average of $21,000 in state and local taxes in 2014. Those deductions helped taxpayers reach the itemization threshold easily. Capping the state, local and property tax deductions at $10,000 means that many taxpayers have more difficulty collecting enough deductions to itemize. And if you no longer reach the threshold to itemize, you won’t be able to deduct your charitable donations.

What is the “bunching” strategy and how could it help me?

One tax strategy is called “bunching.” This is when you surpass the itemization threshold by bundling together your tax deductions into a single year, and then take the standard deduction in interim years. This requires careful and intentional timing of expenses you want to deduct.

While you can mix and match any deductions to reach the threshold, charitable giving is an easy lever to pull to put you over the top. Accelerating your giving and donating two years of contributions in one year can go a long way to helping you reach the threshold. It can also help you give more to charity and save more on taxes in the long run.

Take this simple example. Let’s say you and your spouse own your home with no mortgage, and your annual property taxes are $12,000. You usually give about $10,000 annually to a nonprofit. Taking into account the $10,000 cap on your property tax deduction, your itemized deductions total $20,000. If these are your only deductions, it makes sense to take the higher $24,400 standard deduction.

However, if you “bunch” your charitable deductions by making two years’ worth of contributions in one year, your itemized deductions of $30,000 would exceed the standard deduction by $5,600. And if you place your charitable dollars into a donor-advised fund, you can maintain your steady, yearly support to nonprofits of your choice.

Donors who have variable income or the flexibility to defer or accelerate income can take advantage of this strategy for potentially greater tax efficiencies.

Can I still receive a tax benefit for donating assets other than cash?

Yes. Contributing appreciated securities to charity continues to be an invaluable tax strategy, especially with a strong stock market and a reduced corporate tax rate. It’s important to keep in mind that laws limiting your charitable deduction of appreciated securities to 30 percent of adjusted gross income (AGI) still exist.

It may be beneficial to look at new ways to donate—particularly if you are normally a cash donor. Donating appreciated securities means you don’t have to use your after-tax income for giving. Even more importantly, you can minimize capital gains tax that would be due if you sold the securities. Donating highly appreciated assets can reduce your overall income tax liability, reduce capital gains tax and provide a larger donation to charity.

It may be beneficial to look at new ways to donate—particularly if you are normally a cash donor.

How did tax reform create a greater incentive for me to give more?

Two tax code changes made it beneficial to give more to charity, particularly if you are a high-income earner.

Before-tax reform, you could take a deduction for your cash charitable contributions totaling up to 50 percent of your AGI. The new tax code increased that limit to 60 percent, meaning you can take an even larger charitable deduction for greater giving. This can be a tax-savvy move for years when income is particularly high.

In addition, the Pease limitation, which phased out as much as 80 percent of the benefits of charitable and other itemized deductions for higher-income taxpayers, was repealed. If you’re a high-income taxpayer, this means there is now no limit on your total charitable deduction and you can keep more of your itemized deductions.

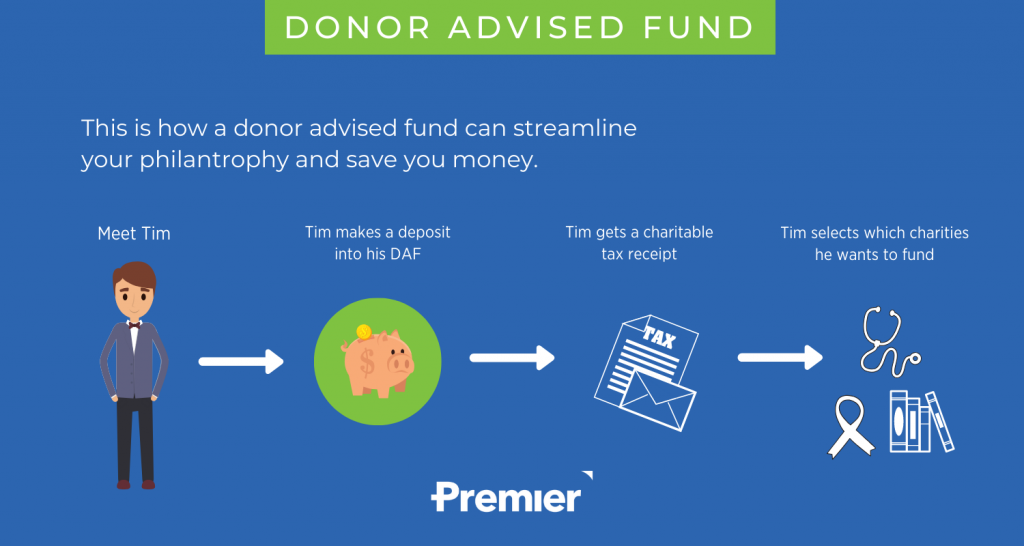

What is a donor-advised fund, and how could it help after tax reform?

A donor-advised fund is a simple and efficient way to implement some of the charitable tax strategies that are most effective after tax reform, such as donating appreciated stock, bunching or front-loading giving in a high-income year. A donor-advised fund is a dedicated charitable account used for the sole purpose of supporting charities you care about.

*You can contribute cash, appreciated assets, or investments, including publicly traded securities, privately held shares or real estate.

What steps should I take next?

It’s a good idea to review your tax strategy and explore all options for maximizing your tax savings. Schedule a meeting with a Premier Wealth Advisor to discuss your charitable giving plan to make sure it’s up-to-date with the current tax law.

To receive an income tax charitable deduction this year, contributions must be made by December 31. It’s more important than ever to make savvy financial decisions about giving. A little planning can ensure that you’re making the right moves—both for yourself and the charities you support.

Let’s Talk