How Premier helps communicate with your employees during open enrollment

Employee benefits and enrollment communication has never been more important. And since enrollment will look different this year—your communications and education strategy will have to change too. We have the multichannel communications you need to succeed.

How does Premier stack up to the average broker?

The average broker may meet your basic plan design and enrollment needs. They’ll provide you with an updated benefits enrollment guide and limited changes. But given this year’s circumstances, enrollment has never been more challenging and essential—meaning you need more than what the standard broker can provide.

The best brokers, especially in today’s uncertain times, will go above the standard services. They’re able to handle any situation and ensure employees and employers are educated, engaged, and enabled through the enrollment process.

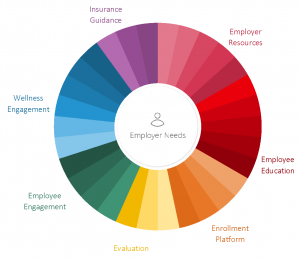

How Premier can help.

We can help you navigate what your open enrollment will look like, provide support and resources to employees, and lead a successful enrollment period in these uncertain times with our full spectrum of solutions.

Contact us today to help you have a successful open enrollment.

Let’s Talk

Do I need to go through open enrollment if I just want to renew my plans? Can you do it for me?

We recommend that employers take their annual open enrollment period to make necessary adjustments to their employee benefits. Benefit information changes from year-to-year and may require a change to your company’s benefits strategy. If your company admin has decided to “plan map” you will automatically be enrolled in the same (or most similar) health plan as the one you originally selected. If they do not have this automated process set up, you must re-select your health plan or you will be denied coverage.

Why would my insurance rates change?

There are many factors that contribute to rate changes, such as plan designs, legally mandated benefits, ACA taxes, and more. The normal trend for medical insurance rates is an increase between 10-12% while dental and vision rates trend around a 2-4% increase.

What happens if I miss the open enrollment window?

This actually depends on how your specific company has chosen to set up its open enrollment process. If you have selected an option that’s referred to as “plan mapping,” then the company will make automatic selections for employees who fail to alter their health plans during the open enrollment period. Without alteration on the part of the employee, the company will keep the individual in the same health plan or in the most similar health plan to the individual’s original selection. If that employee had previously declined coverage, the company will automatically decline coverage once again.

However, if administrators at your company have not selected to “plan map,” then any employee who does not actively make a selection during the open enrollment period will be declined coverage. This is even true for employees who had previously been enrolled in a health plan.

These employees would need to re-select their health plan to continue using it. If the employee fails to do so during the open enrollment period, they can only enroll in health insurance if they experience a qualifying life event. It’s possible that the employer could submit an “exception request” for an employee who missed open enrollment; this would be done through the employer’s broker.

When will I receive my new ID cards?

Carriers send ID cards about 7-14 days after the application has been approved. When a group is going through open enrollment, it is common to receive ID cards around 30 days after the effective date.

Which benefits programs do we choose during open enrollment?

This depends on how the administrator sets up other benefits packages. Sometimes the employers include other benefits, such as commuter benefits or wellness programs, in the same period as health insurance open enrollment. However, the main selection employees will be making is regarding health, dental, and vision insurance plans and carriers.

Are there any benefits I can enroll in after the open enrollment period?

All benefit changes should be made during open enrollment. Changes outside of this period can only be processed if you’ve experienced a sufficient qualifying life event.

I was hired recently and just enrolled. Do I still need to go through the open enrollment selection?

Yes, if the effective date of the company’s open enrollment is after the effective date of the new hire enrollment, you will be required to enroll in coverage again.

If I make a selection and change my mind, can I make a change?

Yes, as long as the change is made before the last date of the open enrollment period, or during the period after a qualifying life event.

What’s the difference between a co-pay and a deductible?

A copay is the amount paid out-of-pocket at a doctor’s appointment or when purchasing a prescription. A deductible is the collective amount of money that is paid out-of-pocket before health insurance carriers begin to cover medical expenses. The deductible is typically calculated on an annual basis, either according to the calendar year or the plan year. It’s important to verify which time frame your deductible adheres to before making selections.

Can I add or remove a dependent to my plan during the open enrollment period?

Yes, Open Enrollment gives you the freedom to make any changes to your coverage such as adding or removing dependents.

If I’m on maternity or paternity leave, do I still need to make selections during open enrollment?

Yes, it is recommended that all employees make their plan selection during open enrollment, even if you’re on paid time off, vacation, or any kind of parental leave. If an employee is unable to make the selection at this time, the administrator should work with their broker or carrier to determine their options for enrollment.

What is a qualifying life event?

A qualifying life event (QLE) is a significant lifestyle change that is either unexpected or unavoidable. In the case of a QLE, employees are able to make changes to their insurance plans outside of the open enrollment cycle. Examples of QLEs are having a baby or divorcing a spouse.

[hubspot type=form portal=7222722 id=b1e8f798-3663-4696-b8ce-ba42ae01e2e0]